The Of Pvm Accounting

The Of Pvm Accounting

Blog Article

What Does Pvm Accounting Mean?

Table of Contents10 Simple Techniques For Pvm AccountingThe smart Trick of Pvm Accounting That Nobody is Discussing5 Simple Techniques For Pvm AccountingPvm Accounting Things To Know Before You BuySome Known Details About Pvm Accounting How Pvm Accounting can Save You Time, Stress, and Money.

Manage and take care of the development and authorization of all project-related billings to clients to cultivate excellent communication and stay clear of concerns. construction taxes. Guarantee that appropriate records and paperwork are sent to and are updated with the internal revenue service. Make sure that the bookkeeping process adheres to the legislation. Apply required building and construction accountancy criteria and treatments to the recording and reporting of building task.Understand and preserve standard cost codes in the accountancy system. Communicate with various funding firms (i.e. Title Firm, Escrow Company) concerning the pay application procedure and demands required for repayment. Manage lien waiver dispensation and collection - https://pvm-accounting-46243110.hubspotpagebuilder.com/blog/building-financial-success-with-construction-accounting. Screen and deal with financial institution problems consisting of fee abnormalities and check distinctions. Assist with applying and maintaining interior economic controls and treatments.

The above declarations are planned to define the general nature and level of job being executed by people designated to this category. They are not to be construed as an extensive checklist of responsibilities, obligations, and skills called for. Workers might be needed to execute tasks beyond their normal obligations once in a while, as required.

More About Pvm Accounting

Accel is looking for a Construction Accountant for the Chicago Office. The Building Accountant does a selection of accounting, insurance compliance, and project administration.

Principal responsibilities consist of, but are not restricted to, dealing with all accounting features of the firm in a timely and precise fashion and offering records and timetables to the business's certified public accountant Firm in the preparation of all economic declarations. Ensures that all accountancy treatments and functions are managed precisely. Liable for all economic documents, pay-roll, financial and daily operation of the accountancy feature.

Works with Task Supervisors to prepare and publish all month-to-month billings. Generates regular monthly Task Price to Date records and working with PMs to integrate with Job Supervisors' budgets for each job.

How Pvm Accounting can Save You Time, Stress, and Money.

Efficiency in Sage 300 Building And Construction and Genuine Estate (previously Sage Timberline Workplace) and Procore construction administration software program an and also. https://www.twitch.tv/pvmaccount1ng/about. Have to also be proficient in various other computer system software application systems for the preparation of reports, spreadsheets and other accounting evaluation that you can check here might be called for by management. Clean-up bookkeeping. Need to possess solid business skills and capability to prioritize

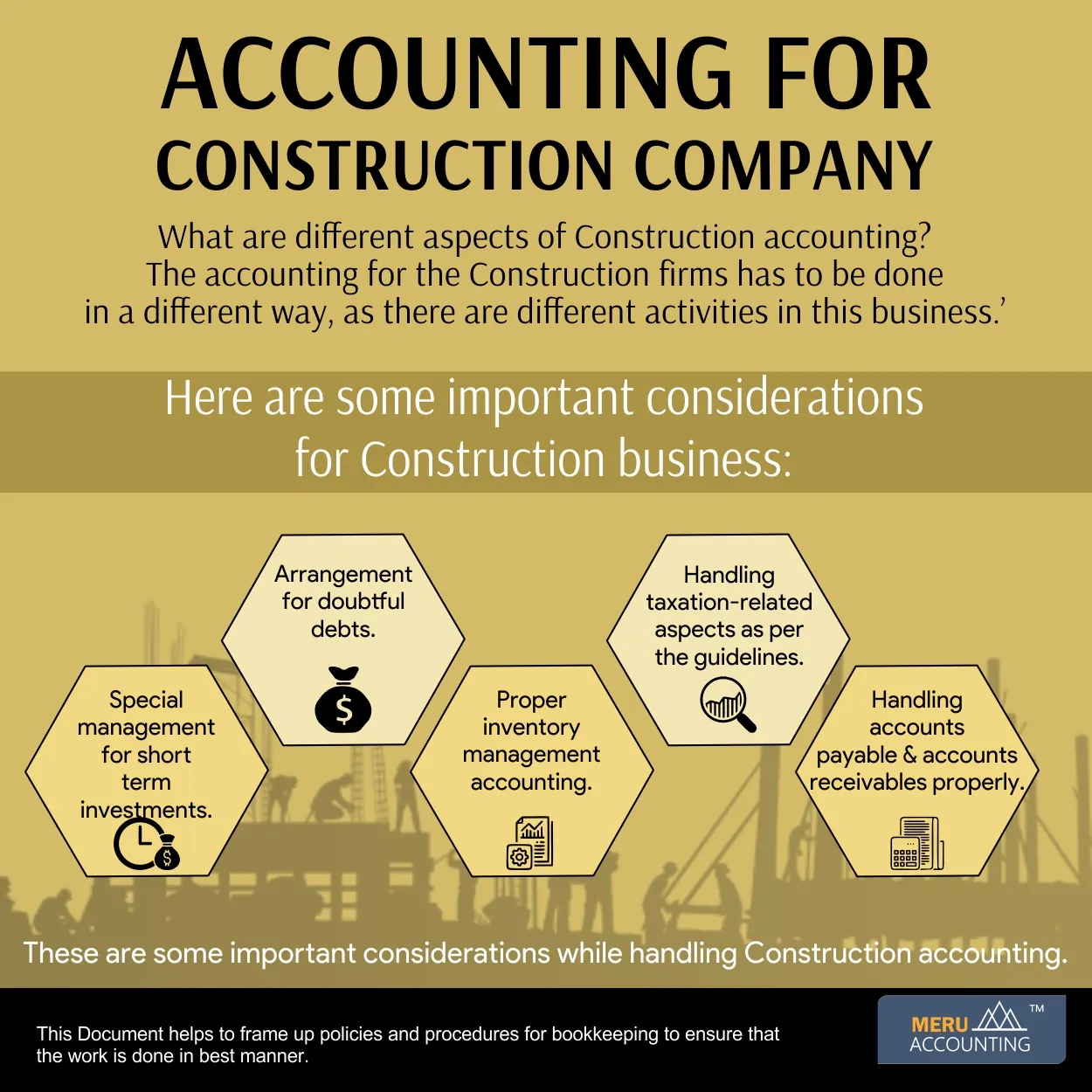

They are the economic custodians who guarantee that building and construction jobs stay on budget, follow tax policies, and keep financial openness. Building accountants are not just number crunchers; they are tactical companions in the construction procedure. Their primary function is to manage the monetary facets of building jobs, guaranteeing that resources are alloted effectively and monetary threats are reduced.

Some Known Facts About Pvm Accounting.

By maintaining a tight grasp on project financial resources, accounting professionals help avoid overspending and monetary troubles. Budgeting is a cornerstone of successful construction jobs, and building and construction accounting professionals are instrumental in this regard.

Navigating the facility web of tax policies in the construction market can be difficult. Building accountants are well-versed in these policies and ensure that the job abides by all tax needs. This includes handling pay-roll taxes, sales tax obligations, and any kind of other tax obligations specific to building and construction. To succeed in the function of a building accountant, individuals require a solid instructional foundation in bookkeeping and finance.

Additionally, accreditations such as Licensed Public Accountant (CPA) or Qualified Building And Construction Market Financial Expert (CCIFP) are highly regarded in the sector. Building projects often entail tight deadlines, transforming guidelines, and unexpected expenditures.

The Facts About Pvm Accounting Revealed

Expert certifications like certified public accountant or CCIFP are additionally extremely recommended to show expertise in building and construction bookkeeping. Ans: Construction accountants create and check budget plans, identifying cost-saving chances and guaranteeing that the task stays within spending plan. They also track expenditures and forecast monetary demands to avoid overspending. Ans: Yes, building and construction accountants handle tax obligation compliance for building tasks.

Introduction to Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building business have to make tough options among lots of monetary alternatives, like bidding on one project over another, picking funding for products or devices, or setting a project's earnings margin. Construction is an infamously unstable industry with a high failing price, sluggish time to payment, and irregular cash circulation.

Production involves duplicated processes with easily recognizable expenses. Manufacturing needs different procedures, materials, and tools with varying prices. Each job takes area in a new area with varying website conditions and one-of-a-kind difficulties.

Some Known Details About Pvm Accounting

Regular use of various specialty specialists and vendors affects efficiency and cash money flow. Payment shows up in full or with normal repayments for the full agreement amount. Some section of repayment may be held back up until task conclusion also when the specialist's work is completed.

While standard suppliers have the benefit of regulated settings and maximized manufacturing procedures, building and construction firms have to constantly adjust to each brand-new job. Even somewhat repeatable projects require modifications due to website problems and various other aspects.

Report this page